Learning Center

We keep you up-to-date on the latest tax changes and news in the industry.

You May Be Able to Minimize the Tax on Your Social Security Benefits and the Cost of Your Medicare Benefits

Article Highlights:

Income as a Factor

Filing Status as a Factor

85% Maximum Taxable

Base Amounts

Deferring Income

Maximizing IRA Distributions

Gambling Gotcha

Qualified Charitable Distributions

Whether your Social Security benefits are taxable (and, if so, the amount that is taxed) depends on several issues including filing status and income. In addition, the amount that is withheld from your Social Security benefits to pay for your Medicare premiums is similarly determined.

The following facts will help you understand the taxability of your Social Security benefits, how your Medicare premiums are determined and how your actions can affect the outcome for the better or worse as far as taxes and costs are concerned.

For this discussion the term “Social Security benefits” refers to the gross dollar amount of benefits you receive (i.e., the amount before reduction due to payments withheld for Medicare premiums). The tax treatment of Social Security benefits is the same whether the benefits are paid due to disability, retirement or reaching the eligibility age. Supplemental Security Income (SSI) benefits are not included in the computation because they are not taxable under any circumstances.

Taxability of Social Security Benefits - The amount of your Social Security benefits that are taxable (if any) depends on your total income and marital status. If Social Security is your only source of income, it is generally not taxable. On the other hand, if you have a significant amount of other income, as much as 85% of your Social Security benefits can be taxable. If you are married and lived with your spouse at any time during the year and file a separate return from your spouse using the married filing separately status, 85% of your Social Security benefits are taxable regardless of your income. This is to prevent married taxpayers who live together from filing separately, thereby reducing the income on each return and thus reducing the amount of Social Security income subject to tax.

The following quick computation can be done to determine if some of your benefits are taxable:

Step 1. First, add one-half of the total Social Security benefits you received to the total of your other income, including any tax-exempt interest and other exclusions from income.

Step 2. Then, compare this total to the base amount used for your filing status. If the total is more than the base amount, some of your benefits may be taxable.

The base amounts are:

$32,000 for married couples filing jointly;

$25,000 for single persons, heads of household, qualifying surviving spouses (those whose spouse passed away in one of the prior two years) with a dependent child or children, and married individuals filing separately who did not live with their spouses at any time during the year; and

$0 for married persons filing separately who lived together during the year.

Where taxpayers can defer their “other” income, such as Individual Retirement Account (IRA) distributions, from one year to another, they may be able to plan their income to eliminate or minimize the tax on their Social Security benefits for at least one of the years. However, the required minimum distribution (RMD) rules for IRAs and other retirement plans have to be taken into account.

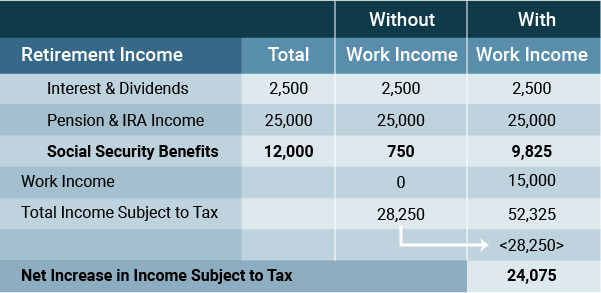

Thus, if your only income is SS benefits, you would likely not be subject to income tax on those benefits. However, if you are drawing SS benefits and working, you may find that the added income from working will cause you to be subject to dual taxation. How can this be, you ask? Since your SS taxation is based upon your income (MAGI), the additional income from working may cause some or a good portion of your SS benefits to be taxable. For example, take a married couple that has a small pension, some investment income, and SS income as detailed in the following table.

In the example above, the $15,000 income from working caused an additional $9,075 ($9,825 - 750) of Social Security to become taxable, in effect causing the couple to be taxed on $1.61 for every $1 earned by working.

A similar issue can occur when withdrawing from an IRA or other retirement plan. Additional IRA withdrawals can have the same effect as working. For example: you decide you need a new car and take a larger than required withdrawal from your IRA account to pay for the vehicle. That extra IRA distribution could create an unpleasant surprise by causing more of your SS benefits to be taxable.

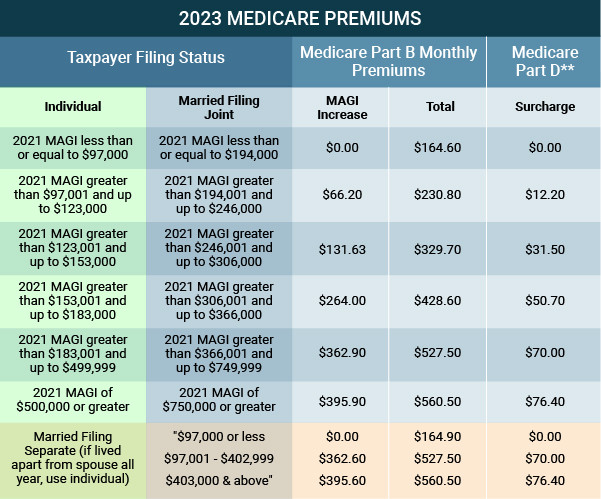

Medicare Insurance Premiums - Your annual letter from the Social Security Administration lets you know how much will be withheld from your monthly retirement benefit for Medicare Part B (medical insurance) and Part D (Prescription Drug Plan).

Not everyone realizes their Part B and Part D benefits are based upon their modified adjusted gross income (MAGI) from two years prior. This means the premiums for 2023 are actually based on your MAGI for 2021.

The MAGI for making the adjustment is the federal AGI (which can be found on line 11 of both Form 1040 and Form 1040-SR) plus the following:

Tax-exempt interest income;

United States savings bonds interest used to pay higher education tuition and fees, if the interest was excluded from income;

Excluded foreign earned income and housing costs;

Income derived from sources within Guam, American Samoa, or the Northern Mariana Islands; and

Income from sources within Puerto Rico.

So, you might discover that even though your monthly Social Security benefits increased because of inflation, the net amount you receive may be less per month because of increases in Medicare Part B and D premiums. Such increases are attributable to increased MAGI 2 years prior.

Tax Trap - If you happen to be a recreational gambler, even though you lost money during the year, your gambling activities can cause an increase in your Medicare costs. How can that be? Well, gambling winnings are included in your AGI while gambling losses are an itemized deduction. Thus, even though the overall result may be a loss, the MAGI is increased by the full amount of the gambling winnings, thus possibly causing increases in the Medicare Part B and D premiums. Of course, this may also cause more of your Social Security benefits to be taxable as well because that computation is also based upon your MAGI.

The letter you received from the Social Security Administration does include an appeal process if you disagree with the Social Security Administration’s decision to increase your premiums. However, this appeal must generally be made within 60 days after receipt of the letter. Unfortunately, an increase in MAGI that put you into the surcharge range as a result of capital gains due to a one-time sale of real property or stock isn’t a valid reason for an appeal.

Strategies

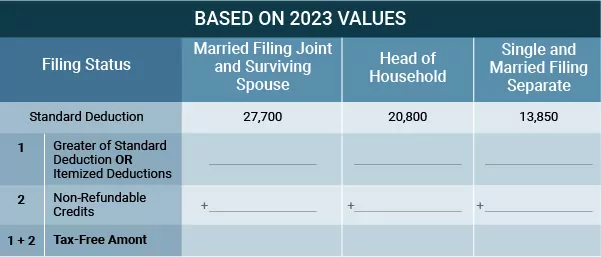

Income Below the Taxable Income Level - Some individuals, even before they begin drawing SS benefits, may find themselves in a year where their income may be less than the taxable threshold for the year. This can be as the result of business loss, loss of employment, or other situations. This provides an opportunity to cash out income from other sources that can avoid taxation. The table below shows the standard deduction which is the amount that is tax free each year.

In addition, if the individuals itemize their deductions, the itemized amount can be substituted for the standard deduction. The tax-free amount can also be increased by certain tax credits. However, tax credits can be either refundable or non-refundable, and since a taxpayer always gets the tax benefit of refundable credits, only consider those that are non-refundable when determining tax free income. Examples of non-refundable credits include the child and dependent care credit, most education credits, and home energy-saving credits.

Although this strategy can come into play in several circumstances, it can best be used to take a distribution from an IRA account after reaching age 59½ and before RMDs are required. Distributions before age 59½ are subject to a 10% early withdrawal penalty. Since withdrawals will reduce the balance of the IRA, the RMD from the IRA is also reduced, which in turn may lower the taxable amount of SS benefits and perhaps even reduce the Medicare premiums.

The IRA distribution can be set aside in a savings account for retirement.

Qualified Charitable Distributions - Tax law also permits individuals aged 70½ or over to directly transfer funds from their IRA accounts to charities in what is referred to as Qualified Charitable Distributions (QCDs). These QCDs are not taxable and where a taxpayer is also required to make required minimum distributions, the QCDs count toward the RMD requirement.

Thus where an individual has reached the age where they are required to take RMD, they can utilize this provision of the law to make their charitable contributions and reduce their AGI and perhaps reduce taxable SS benefits and or Medicare premiums.

If you have questions related to managing the taxability of your Social Security benefits and their taxation or controlling the cost of your Medicare premiums, please give this office a call. There are often planning strategies that may lessen the tax bite and premium costs.

Want our best tax and accounting tips and insights delivered to your inbox?

Sign up for our newsletter.